By breadpointofsale December 23, 2025

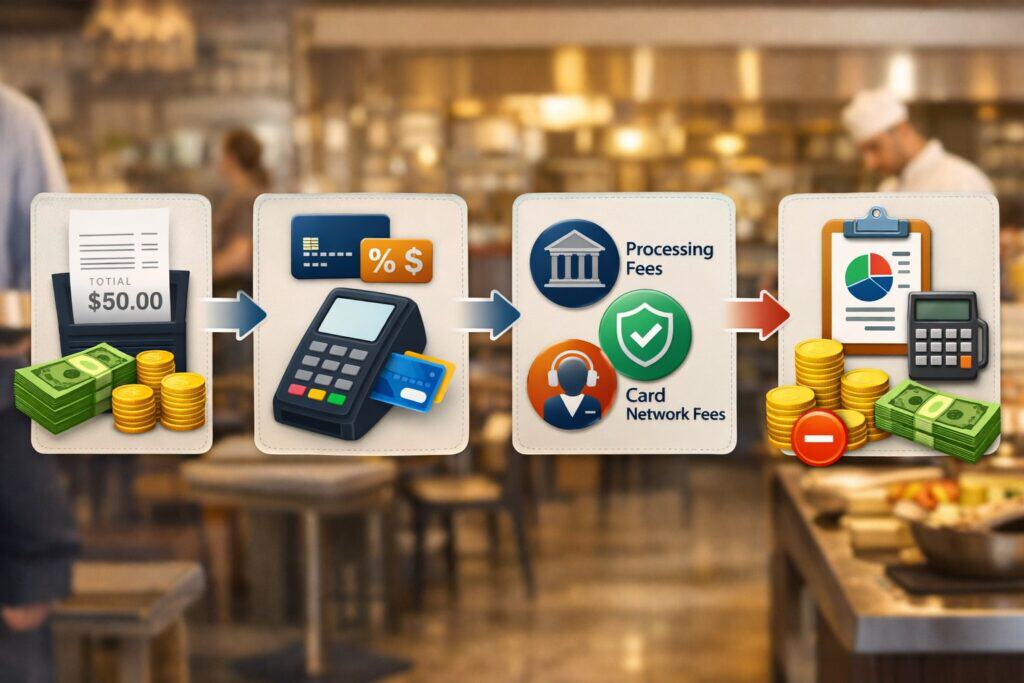

A merchant fee at a restaurant is the bundle of charges a restaurant pays to accept card and digital payments—most commonly credit cards, debit cards, and contactless wallets.

In everyday terms, when a guest taps, inserts, or swipes a card, the restaurant doesn’t receive the full ticket amount. A portion is deducted as a merchant fee, and the remaining amount is deposited to the restaurant’s bank account after settlement.

It helps to think of a merchant fee at a restaurant as the “cost of getting paid” through modern payment networks.

Restaurants pay these fees because card acceptance requires multiple parties to do work behind the scenes: the cardholder’s bank (issuer), the card network, and the restaurant’s payment processor (often paired with a point-of-sale system). Each party takes a slice in exchange for moving money securely, authorizing the purchase, and reducing fraud risk.

A merchant fee at a restaurant is usually measured in two ways: a percentage of the sale (for example, 2.6%) plus a fixed per-transaction amount (for example, $0.10). Those two pieces matter a lot in food service because restaurants run many small-to-mid sized tickets, and the per-transaction part can add up quickly over hundreds of daily orders.

Merchant fee outcomes also differ based on how the payment happens—card-present at the counter, tableside, online ordering, delivery, or keyed entry—because risk and routing costs change.

While many owners see the merchant fee at a restaurant as a single line item, it’s actually a stack of fees with different causes, different recipients, and different ways to manage them. Understanding the stack is the fastest path to lowering total cost without sacrificing guest experience.

How a Merchant Fee at a Restaurant Is Calculated

A merchant fee at a restaurant is calculated from a combination of base network costs and your processor’s pricing, plus any add-on services you use. In most cases, the “base” portion is made of interchange and network assessment charges.

Interchange is generally tied to the cardholder’s issuing bank, while assessments are tied to the card networks. Your payment processor then adds a markup (also called margin) for providing the merchant account, gateway access, support, and risk monitoring.

Mastercard explains interchange as one component of the Merchant Discount Rate (MDR) paid by merchants to acquirers.

From a restaurant perspective, the merchant fee at a restaurant can change from transaction to transaction even within the same shift. A rewards credit card used tableside may trigger a different interchange category than a basic debit card used at the counter.

If the guest uses a corporate card, that can also shift the base cost. The method of acceptance matters too: a chip/tap transaction is generally considered lower risk than a manually keyed transaction, so a keyed payment can carry a higher merchant fee.

Your pricing model determines how clearly you see these moving parts. With interchange-plus (also called cost-plus), your statement typically shows interchange and assessments passed through at cost, plus a consistent processor markup.

With flat-rate pricing, you see a single “blended” rate, and the processor absorbs the variability. Flat-rate can be simple, but it can also hide which transactions are driving your merchant fee at a restaurant upward.

The final merchant fee can also include PCI-related charges, monthly account fees, POS software subscriptions, chargeback fees, and gateway fees. Some restaurants treat these as “operating costs” rather than payment costs, but they still affect the real, all-in merchant fee at a restaurant.

The best way to judge the true cost is to calculate your effective rate: total processing costs divided by total card sales for the month.

The Main Components of a Merchant Fee at a Restaurant

A merchant fee at a restaurant is commonly made of three core layers: interchange, assessments, and processor markup. Even if your statement only shows a blended rate, these layers still exist in the background.

Visa notes that merchants negotiate and pay a “merchant discount” to their financial institution, and that processing services can be included in that merchant discount rate.

Interchange Fees

Interchange is usually the largest portion of the merchant fee at a restaurant. It is the amount tied to the cardholder’s issuing bank for accepting that specific card type under that transaction’s conditions.

Interchange is not a single rate; it’s a matrix that can vary by card brand, card product (debit, credit, rewards, commercial), and acceptance method. Restaurants feel this strongly because they accept a wide mix of card types and they process many moderate tickets.

Interchange is also why two restaurants across the street from each other can experience different overall merchant fee performance even if they process the same sales volume.

If one restaurant has more premium rewards cards and more online orders, interchange outcomes can be higher. If another has more regulated debit usage and more in-person chip transactions, interchange outcomes can be lower. The difference isn’t “luck”—it’s the blend of transactions.

Interchange schedules also update periodically, which can move restaurant costs up or down over time. In practice, many restaurant owners notice changes when network updates happen and their effective rate shifts even though their processor markup didn’t change.

That’s why an owner who wants a stable merchant fee at a restaurant should track the effective rate monthly, not just the quoted rate.

Network Assessments and Brand Fees

Network assessments (sometimes called dues and assessments) are paid to the card networks for operating the rails, setting standards, and managing the ecosystem.

They tend to be smaller than interchange but still meaningful for a restaurant because volume is high. Some networks also have additional brand fees tied to cross-border activity, tokenization, dispute programs, or data usage.

Assessments can rise when the payment type changes. For example, certain e-commerce or card-not-present transactions can include additional network-related risk programs.

If a restaurant adds online ordering, delivery integrations, QR ordering, or subscription-style meal programs, the network fee mix can shift, affecting the merchant fee at a restaurant.

Because assessments are generally non-negotiable at the restaurant level, the best way to manage their impact is operational: keep more transactions card-present when possible, reduce keyed entry, and ensure your setup supports tokenization and secure credentials for recurring payments.

That won’t eliminate assessment costs, but it can prevent avoidable surcharges within the network ecosystem.

Processor Markup and Pricing Structure

Processor markup is the part of the merchant fee at a restaurant you can usually negotiate the most. It’s what the processor (and sometimes the acquiring bank) earns for delivering the merchant account, routing, reporting, support, and risk services. Markup can be charged as a percentage, a per-transaction amount, monthly fees, or a combination.

Markup depends heavily on your pricing model. With interchange-plus, you might pay something like interchange + 0.30% + $0.10. With a flat-rate plan, you might pay 2.6% + $0.10 on every transaction, regardless of the underlying card cost.

Flat-rate can be convenient for new restaurants, but as volume grows, interchange-plus often makes it easier to keep the merchant fee at a restaurant aligned with your actual risk profile.

Markup is also where “junk fees” can sneak in. Examples include statement fees, monthly minimums, PCI program fees, batch fees, and non-compliance penalties.

None of these are automatically “bad,” but they must be understood. A restaurant that focuses only on headline rate can end up with a higher true merchant fee once monthly fees are included.

Typical Merchant Fee Ranges for Restaurants

Restaurant owners often ask, “What’s a normal merchant fee at a restaurant?” The honest answer is: it depends on ticket size, payment mix, and pricing model. Still, you can benchmark. Recent industry summaries commonly cite averages that vary by network and whether the transaction is in-person or online/manual.

For example, one 2025 compilation (using a processor’s weighted data) lists in-person averages by network around the ~1.8% to ~2.6% range plus per-transaction fees, with online/manually keyed higher.

Those averages can be misleading if you don’t compare apples to apples. A casual dining restaurant with many tips and higher tickets may see a different effective rate than a quick-service restaurant with many sub-$15 tickets. The per-transaction fee portion matters more when tickets are small.

For instance, $0.10 on a $10 sale is effectively 1% by itself, before any percentage fee is applied. That’s why the merchant fee at a restaurant is not just about “rate”—it’s about rate plus per-item cost in a high-transaction environment.

Channel mix is another major driver. Online ordering and delivery can raise the merchant fee at a restaurant because card-not-present transactions typically cost more than chip/tap transactions due to higher fraud and dispute risk.

If your restaurant uses manual entry for phone orders, that can further elevate costs. On the other hand, encouraging tap-to-pay, chip, and secure tokens for saved cards can keep the merchant fee at a restaurant more stable.

A practical benchmarking approach is to look at three numbers monthly:

- Effective rate (total fees ÷ card sales)

- Average ticket (card sales ÷ transactions)

- Card-not-present share (online/delivery volume ÷ total volume)

When these are tracked together, you can tell whether a merchant fee spike is due to pricing changes, a shift in guest behavior, or an operational issue like too many keyed transactions.

Restaurant-Specific Factors That Increase or Reduce Merchant Fees

A merchant fee at a restaurant is heavily shaped by how restaurants operate. Unlike many retail businesses, restaurants deal with tipping, pre-authorizations, split checks, bar tabs, and delivery platforms—each of which can alter fee outcomes.

Tips, Adjustments, and Pre-Authorizations

Many restaurants authorize a card for one amount and then adjust it later after the tip is added. If your setup doesn’t handle these flows correctly, you can see more downgrades, higher fees, or even avoidable chargebacks. A smooth tip-adjustment workflow keeps the merchant fee at a restaurant predictable because it reduces exceptions and dispute risk.

Bars that use open tabs also rely on pre-authorizations. If the initial authorization is too small or if a tab remains open too long, you can face authorization issues that increase declines and push staff toward manual entry—raising the merchant fee at a restaurant. Optimizing your POS settings and staff training can reduce these friction points.

Online Ordering, Delivery, and Marketplace Apps

Delivery marketplaces can change the economics of your merchant fee at a restaurant in two ways: (1) the payment may be processed by the marketplace, meaning you pay marketplace commissions rather than processing fees; or (2) the payment may be processed by you through integrated online ordering, which can introduce higher card-not-present costs.

In the second scenario, your fraud tools, address verification settings, and tokenization capability matter.

Restaurants that run their own online ordering often see better margins than marketplace-only models, but they must manage payment risk to prevent disputes. Reducing disputes keeps the merchant fee at a restaurant lower because chargebacks cost money directly and can increase risk monitoring.

Card-Present Technology and Staff Habits

The fastest operational way to manage a merchant fee at a restaurant is to reduce avoidable “expensive” transaction types. Encourage chip and tap usage. Avoid keying cards whenever possible. Keep terminals updated. Use EMV-capable and contactless-capable devices.

Staff habits matter too. If servers frequently key cards due to convenience or a broken reader, the merchant fee at a restaurant will rise. If the team consistently batches out at the right time, you reduce settlement delays and some processing complications.

If receipts and tip adjustments are handled cleanly, you reduce disputes. All of this lowers your true merchant fee over time.

Merchant Fee Strategies: Passing Costs to Guests vs. Absorbing Them

Restaurants often debate whether to absorb the merchant fee at a restaurant as a cost of doing business or pass some of it to guests through pricing strategies. There’s no single best answer; it depends on your market, your brand positioning, and the rules that apply in your area.

Surcharging Rules and Practical Realities

A surcharge is an additional charge applied when a customer pays with a credit card. Visa’s guidance describes a surcharge as an added fee for using a particular form of payment and notes that merchants in most states may add a surcharge to credit card transactions, subject to limitations.

Surcharging can reduce your effective merchant fee at a restaurant, but it introduces guest-experience risk. Guests may feel “nickel-and-dimed,” especially if the surcharge appears late in the checkout flow.

Operationally, surcharging also requires careful compliance: disclosures, correct application by payment type, and adherence to network limits. Importantly, debit surcharging is generally not allowed under card network rules—so restaurants must set up their systems carefully to avoid accidentally applying the fee to debit transactions.

For restaurants, a practical best practice is transparency. If you choose surcharging, disclose it clearly at entry points and at the point of sale, and train staff to explain it calmly. When done cleanly, it can stabilize margins. When done poorly, it can reduce repeat visits.

Cash Discount Programs

A cash discount program flips the framing: instead of charging extra for cards, you post a regular price and offer a discount for cash (or sometimes other non-card methods). Many POS providers publish compliance notes emphasizing that merchants are responsible for following laws and card brand rules when offering cash discounting.

Restaurants like cash discounting because it can reduce effective merchant fee pressure while avoiding some of the guest backlash associated with explicit card surcharges. Still, the program must be implemented correctly.

Pricing displays must be consistent, signage must be clear, and staff must explain it simply. If a guest feels tricked at checkout, it harms the brand even if the restaurant technically follows rules.

Menu Price Adjustments and Service Charges

Many restaurants choose the simplest approach: increase menu prices modestly and absorb the merchant fee at a restaurant within normal pricing. This avoids compliance complexity and keeps checkout smoother. The downside is that your prices may look higher on menus and on marketplace apps.

Some restaurants use a service charge or “administrative fee.” That can work, but it often triggers guest questions. If you choose a service charge approach, clarity matters: define what it supports, keep it consistent, and ensure staff can explain it.

From a margin standpoint, the goal is to keep the merchant fee at a restaurant from eroding profitability while maintaining trust.

How to Lower a Merchant Fee at a Restaurant Without Hurting Operations

If you want a lower merchant fee at a restaurant, focus on changes that reduce cost while keeping throughput high and disputes low. The best wins usually come from a mix of pricing optimization and operational improvements.

Choose the Right Pricing Model and Audit Your Statement

Start by identifying whether you’re on flat rate, tiered, or interchange-plus. Interchange-plus often gives the clearest view of what’s happening and makes it easier to measure improvements.

Then audit your monthly statement for extra fees: PCI fees, non-compliance charges, batch fees, statement fees, gateway fees, and monthly minimums.

Negotiate markup where appropriate. Restaurants with steady volume and low chargebacks often qualify for better terms. If your processor won’t explain your merchant fee stack clearly, that’s a sign you may be overpaying.

Reduce Card-Not-Present Risk and Disputes

Chargebacks are a hidden “multiplier” on the merchant fee at a restaurant. They create direct costs (chargeback fees), indirect costs (lost product and labor), and risk costs (higher scrutiny). Tighten your refund and cancellation policies, make receipts detailed, and ensure your descriptor (what shows on a customer’s statement) is recognizable.

For online orders, use secure checkout, tokenization, and fraud screening that matches your risk profile. A restaurant doesn’t need enterprise-level fraud tooling, but it does need consistent basics. Fewer disputes usually mean a healthier merchant profile and a more stable merchant fee.

Improve Checkout Flow and Hardware Reliability

Keep terminals updated and functioning. Enable contactless. Use tableside payment where it makes sense to reduce mishandling and improve tip confidence. Train staff to avoid keying cards unless absolutely necessary.

Also review your batching/settlement timing. While batching doesn’t usually change interchange directly in obvious ways, clean settlement reduces operational issues that can lead to manual workarounds—and those workarounds often raise the merchant fee at a restaurant.

Optimize Ticket Size and Payment Mix Thoughtfully

You can’t force guests to use a cheaper card, but you can influence behavior with gentle nudges. For example, encouraging contactless and reducing phone-keyed orders can lower costs.

For very small tickets (coffee, snacks), consider whether a minimum card purchase policy is allowed in your area and fits your brand, or whether you can bundle items to raise the average ticket.

The goal is not to “game” guests—it’s to design a checkout experience that naturally reduces the most expensive transaction types. That’s how restaurants sustainably manage the merchant fee at a restaurant without sacrificing hospitality.

Future Predictions: Where Restaurant Merchant Fees Are Headed

The merchant fee at a restaurant is likely to keep evolving as payment choices and regulations shift. Several trends stand out.

First, more contactless and tokenized payments will continue. Tokenization reduces exposure of card numbers and can reduce fraud risk in digital channels. Lower fraud risk doesn’t automatically slash base interchange, but it can reduce chargebacks and help restaurants avoid costly exceptions that inflate the true merchant fee.

Second, account-to-account and real-time payment rails are expanding. As these options become more consumer-friendly, restaurants may adopt them for certain use cases—like catering deposits, private dining invoices, or large events—where card fees are most painful.

If guests and businesses increasingly use bank-based instant payments for higher-ticket payments, restaurants could reduce their reliance on card rails for those scenarios, lowering blended merchant fee impact.

Third, pricing transparency pressure is rising. Consumers are noticing payment-related add-ons more than they did a few years ago, and industry discussion around surcharges has intensified.

Some reporting highlights growing consumer exposure to surcharges and the tension between fee recovery and customer experience. Even if you never surcharge, this environment affects guest expectations—meaning restaurants may need clearer signage and simpler pricing narratives.

Finally, expect POS platforms to bundle payments more tightly with software and hardware. That can streamline operations, but it can also make merchant fees at a restaurant comparisons harder because processing rates, POS subscriptions, and hardware costs blend together.

The winning strategy will be to evaluate the full cost of acceptance—fees plus software plus support—against measurable outcomes like labor savings, faster checkout, higher tips, and fewer disputes.

FAQs

Q.1: What is the difference between a merchant fee and interchange?

Answer: A merchant fee at a restaurant is the total amount you pay to accept a card payment. Interchange is only one part of that total. Interchange is the base fee associated with the cardholder’s issuing bank, and it varies by card type and transaction method.

The merchant fee also includes network assessments and your processor’s markup, plus potential monthly or per-incident fees like PCI charges or chargeback fees.

For restaurant owners, this distinction matters because interchange is mostly non-negotiable, while processor markup and add-on fees often are.

If you only shop based on a single “rate,” you can miss expensive monthly charges that raise the all-in merchant fee. Interchange-plus pricing tends to show the difference more transparently than flat-rate pricing.

A practical way to see the difference is to calculate your effective rate monthly. If your processor markup is fixed, but your effective rate swings, that’s often interchange mix changing—more premium rewards cards, more online orders, or more keyed transactions.

Understanding interchange helps you control the operational drivers that influence the merchant fee at a restaurant.

Q.2: Why does my merchant fee change from month to month?

Answer: Your merchant fee at a restaurant can change because your transaction mix changes. If you have more online orders, more keyed entries, more corporate cards, or more premium rewards cards in one month, the base costs can rise. If you have more debit usage and more chip/tap transactions, costs can fall.

Seasonality also plays a role. Holidays can increase gift card usage, catering deposits, and larger tickets, while slow seasons can shift toward smaller tickets where per-transaction fees weigh more heavily. Promotions and third-party delivery partnerships can also change how payments are processed, which affects the merchant fee.

Finally, fee schedules and program changes can occur periodically across networks and processors. Even if your processor markup stays the same, updates in underlying fee categories can move your effective rate.

That’s why restaurants should track monthly metrics—effective rate, average ticket, and card-not-present share—to explain merchant fee movement logically.

Q.3: Can restaurants legally add a credit card surcharge?

Answer: In many locations, restaurants may add a surcharge to credit card transactions, but the rules depend on state-level requirements and card network rules. Visa’s guidance describes what a surcharge is and notes that merchants in most states may surcharge credit card transactions, subject to limitations.

Even when surcharging is allowed, compliance details matter: clear disclosure, correct configuration, and ensuring the surcharge is applied only where permitted. Debit surcharging is generally prohibited under network rules, so restaurants must ensure their POS or terminal doesn’t accidentally surcharge debit cards.

Because rules and enforcement can vary, restaurants typically treat surcharging as a compliance project, not just a pricing tweak. If you’re considering it, your safest approach is to confirm local requirements, ensure signage and receipts are correct, and test your terminal setup carefully so your merchant fee recovery doesn’t create new risk.

Q.4: Is a cash discount the same thing as a surcharge?

Answer: A cash discount is not the same as a surcharge, even though both aim to offset the merchant fee at a restaurant. A surcharge adds a fee for using a credit card. A cash discount offers a lower price for paying with cash (or another non-card method), while the “regular” price applies otherwise.

Restaurants often prefer cash discounting because it can feel more guest-friendly: “pay cash, save money.” However, the program must be implemented correctly with transparent pricing and compliant signage.

POS providers emphasize that merchants are responsible for compliance with laws and card brand rules when using cash discount programs.

From a practical standpoint, the best choice depends on your guest base. If most guests pay by card and dislike add-on fees, a modest menu price adjustment may protect the brand better than a surcharge.

If your area is cash-heavy and guests respond well to discounts, cash discounting may reduce the merchant fee burden while keeping sentiment positive.

Q.5: What’s a good target effective rate for a restaurant?

Answer: A “good” target depends on your concept, ticket size, and payment channels. Quick-service restaurants with small tickets often have a higher effective rate than fine dining because per-transaction fees make up a bigger share of each sale.

Restaurants with large online ordering volume may also see higher costs than those mostly processing chip/tap transactions in person.

Instead of chasing a universal number, aim for improvement against your own baseline. Track your merchant fee at a restaurant as an effective rate monthly and break it down by channel (in-store vs. online).

If you can reduce keyed transactions, reduce disputes, and negotiate processor markup, you can often lower the effective rate meaningfully without changing the guest experience.

Using published averages as rough context can help, but don’t treat them as a guarantee. Your best benchmark is your own trend line: if your effective rate rises, diagnose mix changes; if it stays stable while sales grow, you’re managing your merchant fee at a restaurant well.

Q.6:Should I switch processors to lower my merchant fee?

Answer: Switching processors can reduce a merchant fee at a restaurant, but only if you compare the full cost structure—not just the advertised rate. A new processor might offer a lower percentage but add monthly platform fees, higher per-transaction fees, or expensive support tiers.

Restaurants should evaluate: pricing model, markup, monthly fees, contract terms, chargeback fees, and equipment costs.

Before switching, ask for a detailed proposal that reflects your real transaction mix (average ticket, in-person vs. online, card types). Then compare your current and proposed effective rate based on actual statements.

If your current processor can match pricing and improve transparency, you might reduce your merchant fee without changing operations.

If you do switch, plan the operational transition carefully. A restaurant’s payment flow is mission-critical. The best processor isn’t only the cheapest—it’s the one that keeps payments reliable during rush hours, reduces exceptions, and gives you tools to manage risk. Reliability and lower disputes often translate into a lower true merchant fee at a restaurant over time.

Conclusion

A merchant fee at a restaurant is the real cost of accepting modern payments, and it’s more than a single rate. It blends interchange, network assessments, and processor markup—plus operational factors like online ordering risk, staff habits, tips, and disputes.

When you understand what makes up the merchant fee at a restaurant, you stop guessing and start managing: you negotiate the parts you can control, and you redesign the workflows that quietly drive costs up.

The most effective restaurant strategy is balanced. Protect margins by auditing statements, choosing a pricing model that matches your volume, and reducing expensive transaction types like keyed entries.

Protect the guest experience by keeping pricing simple and transparent, whether you absorb fees, adjust menu prices, or implement a carefully compliant surcharge or cash discount program.

And protect the future by watching where payments are headed—more contactless, more tokenization, and growing bank-based instant payment options that may reduce dependence on card rails for certain high-ticket use cases.

Ultimately, the goal isn’t to eliminate the merchant fee at a restaurant—it’s to make it predictable, fair, and aligned with your business model. With the right mix of pricing, compliance awareness, and operational discipline, restaurants can keep payment acceptance smooth for guests and financially sustainable for owners.